Instructions for Completing Customs Clearance Agent Form

Please complete two of the following Customs Clearance Forms in order for us to be able to perform the customs clearance on your behalf. Please complete and return via the link below.Please Note: Forms need to be signed by a company Director or Secretary.

If you have an Irish TAN A/c please complete E2G Direct Representative Form + Customs and Excise Clearance Agent Form. In this form you are authorising Easy2go Logistic to use your TAN account to pay VAT and duty.

If you do not have TAN A/c with customs, please complete: E2G Direct Representative Form + AEP1 Form. In this case if there will be a need to pay VAT and duty, we can do it using our Easy2go Logistic TAN account, and you will need to pay us before we clear your shipment.

Details of all the boxes that need to be completed for all forms are below.

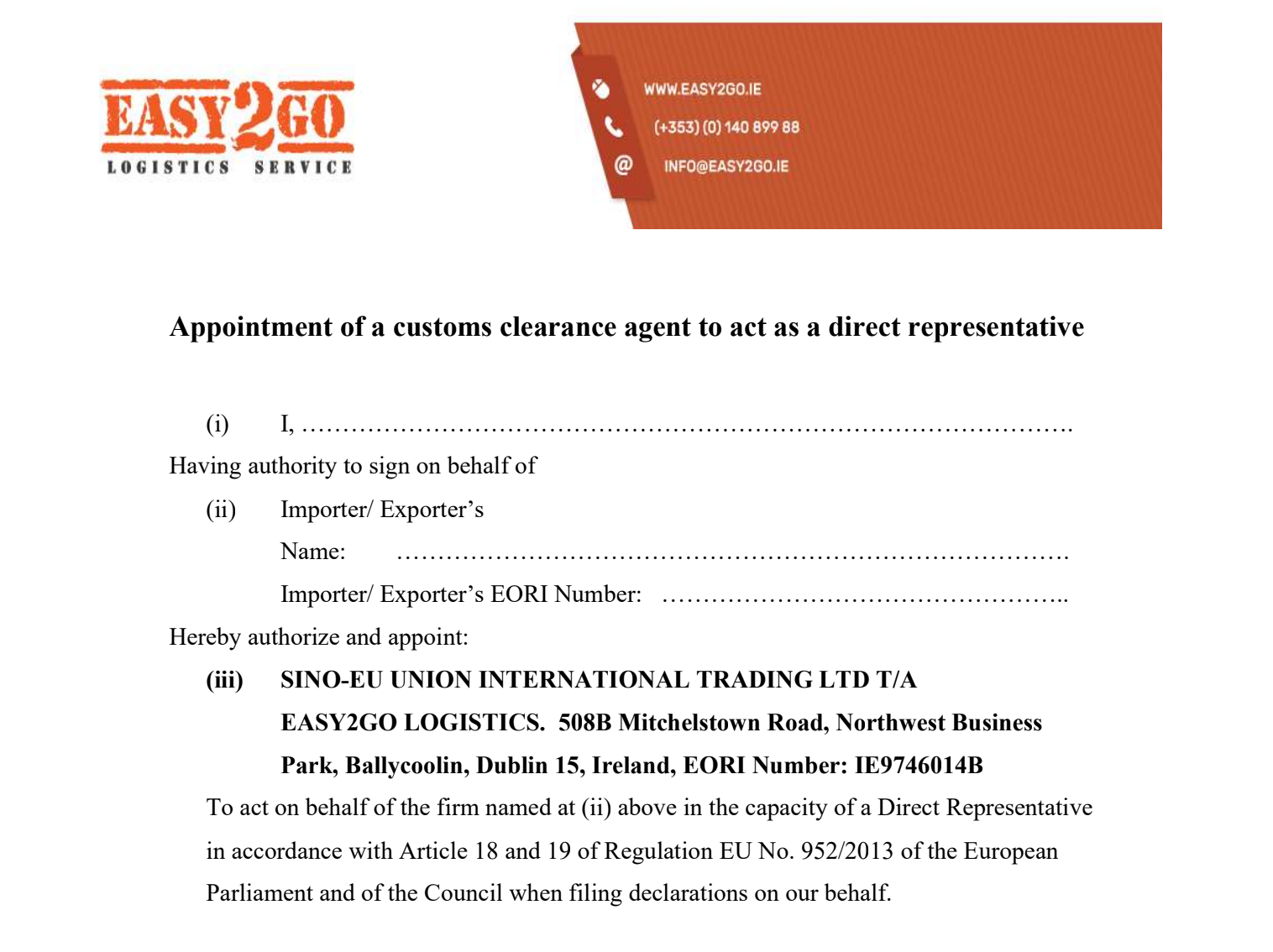

Form 1: E2G Direct Representative Form,

-Person name

-Appoint party (Your Business name)

-EORI No.

-Printed Name

-Signature (company Director or Secretary)

-Position / Job Title

-Date

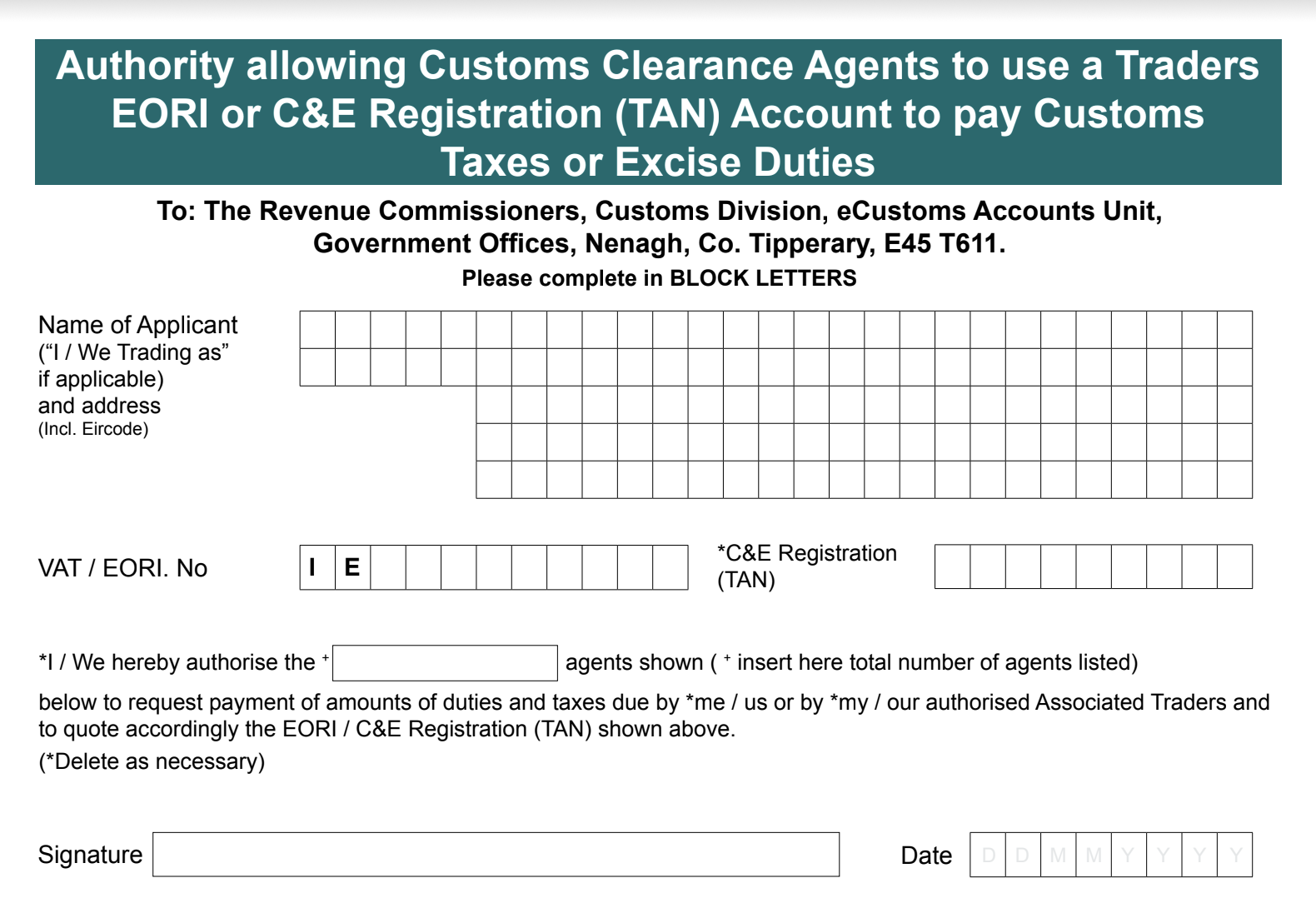

Form 2: Customs and Excise Clearance Agent Form.

- Company Name

- Company Address

- Company Vat Registration Number / EORI. No

- TAN no.

- Number of agents to be authorised to use your TAN account

- Signature (company Director or Secretary)

- Date

- Status

- Telephone and Email Address

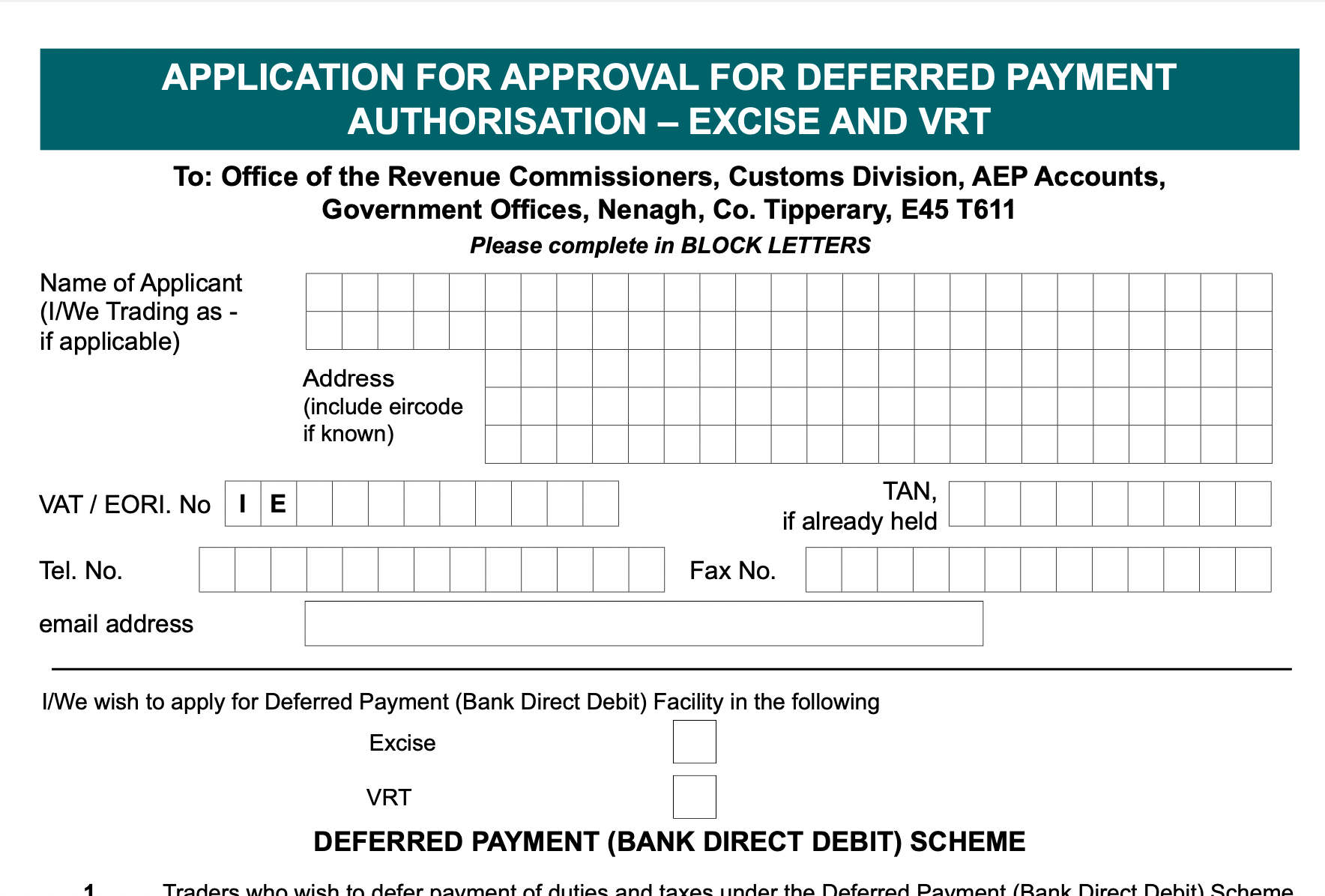

Form 3: AEP1

- Company Name

- Company Address

- Vat Registration Number / EORI. No

- Telephone No, Email Address, Fax No.

- Tick Payment Facility

- Signature (company Director or Secretary)

- Date

- Status